iGuideline is the most powerful App available in Canada for calculating Child and Spousal Support.

iGuideline allows parents, lawyers, and other Professionals, to perform all the calculations required under the Canadian Child Support Guidelines for all Provinces and Territories (Except Quebec), including:

• the Table Amount payable under Section 3 of the Guidelines for sole, joint, shared, and split custody situations;

• a payors proportionate share of the “net” costs of Special and Extraordinary Expenses under Section 7 of the Guidelines;

• the Households Standards of Living test under the Undue Hardship provisions of the Guidelines.

Some of iGuidelines powerful features include:

• the ability to perform calculations under the Child Support Guidelines for all years from 2012 to 2020;

• iGuideline uses the latest Tables under the Federal Child Support Guidelines which came into effect November 22, 2017;

• a Basic Income mode for situations where income information is simple so users can enter income information, and common adjustments under the Guidelines, on one simple and easy to understand screen;

• a Detailed Income mode for situations where income information is more complicated (rental income, persons with income from Dividends, etc.) which allows users to enter all the different types of income, and all the allowable adjustments under the Guidelines.

• detailed calculations showing the tax savings and increased benefits arising from claims for Special and Extraordinary Expenses under Section 7, with a summary of the “net” costs of those expenses (it is the “net” costs of Section 7 expenses that are shared between the parents).

• the ability to display further details about calculated numbers within Popovers.

• support for split and shared custody arrangements.

• an intuitive “Is Extraordinary Rating” feature that gives users an indication about whether school expenses and expenses for extracurricular activities are “extraordinary” or not (those types of expenses must be "extraordinary" to be allowable as additional amounts payable under Section 7 of the Guidelines).

• the ability to override the Section 3 Table Amount payable;

• the ability to override the percent share of Section 7 Expenses;

• details of the various Federal and Provincial Benefits that a parent will receive (CCB, GST Tax Credit, and Provincial Benefits, etc.);

• a powerful Spousal Support Advisory Guidelines (SSAG) Module, with the ability to perform calculations using the benefits payable in the year of the calculation or those payable based on the income for the year.

• the ability to override the Guideline Income amount for SSAG Module calculations.

• the ability to view details of the Taxes Payable, and Benefits for SSAG With Children Formula calculations.

• a “Find a Professional” feature to allow users anywhere in Canada to find lawyers and other Professionals in their city who provide services to parents who are dealing with separation issues.

• support for storing files in iCloud so users can access their files from all their computers at home or work.

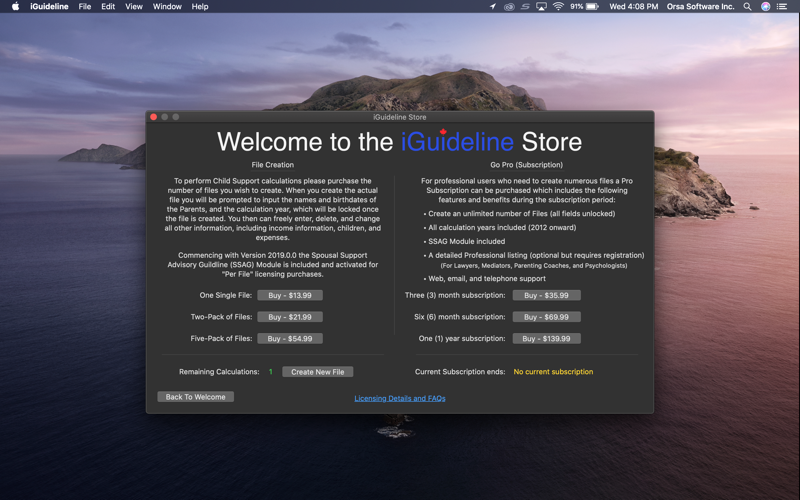

iGuideline is free to download and users can create a sample file so they can explore iGuidelines many features, including the SSAG Module.

Once users decide they want to do their own calculation they can do so with affordable In-App Purchase options designed to meet the needs of both Parents and Lawyers.

iGuideline is not just a professional grade tool for performing accurate child and spousal support calculations, its also a tool designed to help educate users about the Canadian Child Support Guidelines.

If you are not using iGuideline you are likely in a disadvantaged position when negotiating the issue of child or spousal support, or dealing with these issues in Court.